Next up is the Universe Group.

Wexboy has written about this company in his own inimitable

style and I have nothing to add to his analysis, which I think is spot on.

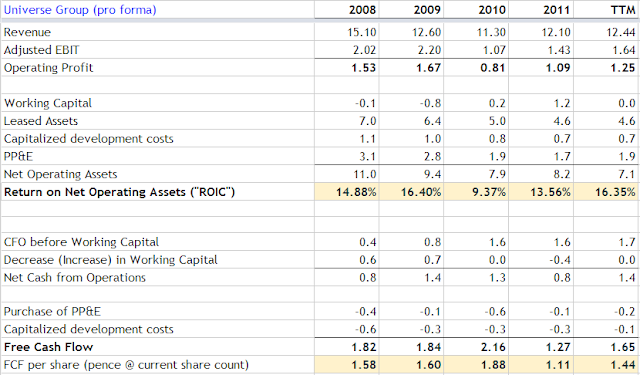

Now that the extraneous businesses have been shed, and the

core petrol forecourt/retail payments business is all

that remains, we can have a look at its historical, pro-forma profile:

A valuation of ~6.4p is not unreasonable:

Half-price is fine, but there are currently (still) many decent

UK stocks selling at half price.

I have included it in my UK picks for 2013

because I think that there’s a more than reasonable chance that it will be

acquired by Vianet after all: Vianet still owns a substantial share of UNG,

and UNG’s business would represent a common sense tuck-in acquisition for

Vianet.

Disclosure: No position

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.